Driving Choice

Workplace Marketplace™

Driving Choice Workplace Marketplace™

is an exclusive healthcare marketplace that gives your employees the most personalized healthcare experience. Employees have the freedom to choose healthcare that best suits their unique needs.

The Status Quo Must Go

Traditional health benefits are too expensive, offer little or no choice, and, with annual rate increases, are no longer sustainable. It’s no secret that the current way of employer-provided benefits is broken and cannot be fixed.

HEALTH BENEFITS ARE NOW A COST YOU CAN CONTROL!

There is a better way. Recent changes in the law give employers complete control over their healthcare costs now and in the future. Your costs are fixed and predictable. Minimal, if any, rate increases can be easily controlled without cost-shifting to employees or cutting benefits.

MORE CHOICE WITH PERSONALIZED BENEFITS AND DEFINED CONTRIBUTION PLANS

Instead of the standard one or two options, the Driving Choice WORKPLACE MARKETPLACE offers true choice with more than 40 plan options from multiple insurance companies. Employees get tax-free money to personalize their benefits with dental, vision, and more to get the perfect coverage for their unique needs.

Savings of 20% to 40% are not uncommon compared to traditional group plans.

Reinvest the savings into your business or share the savings with your employees by adding new and better benefits.

Welcome to the world of Individual Coverage Health Reimbursement Arrangements (ICHRAs).

These plans, born from healthcare reform and the Affordable Care Act, mark a significant shift in how employees access health benefits.

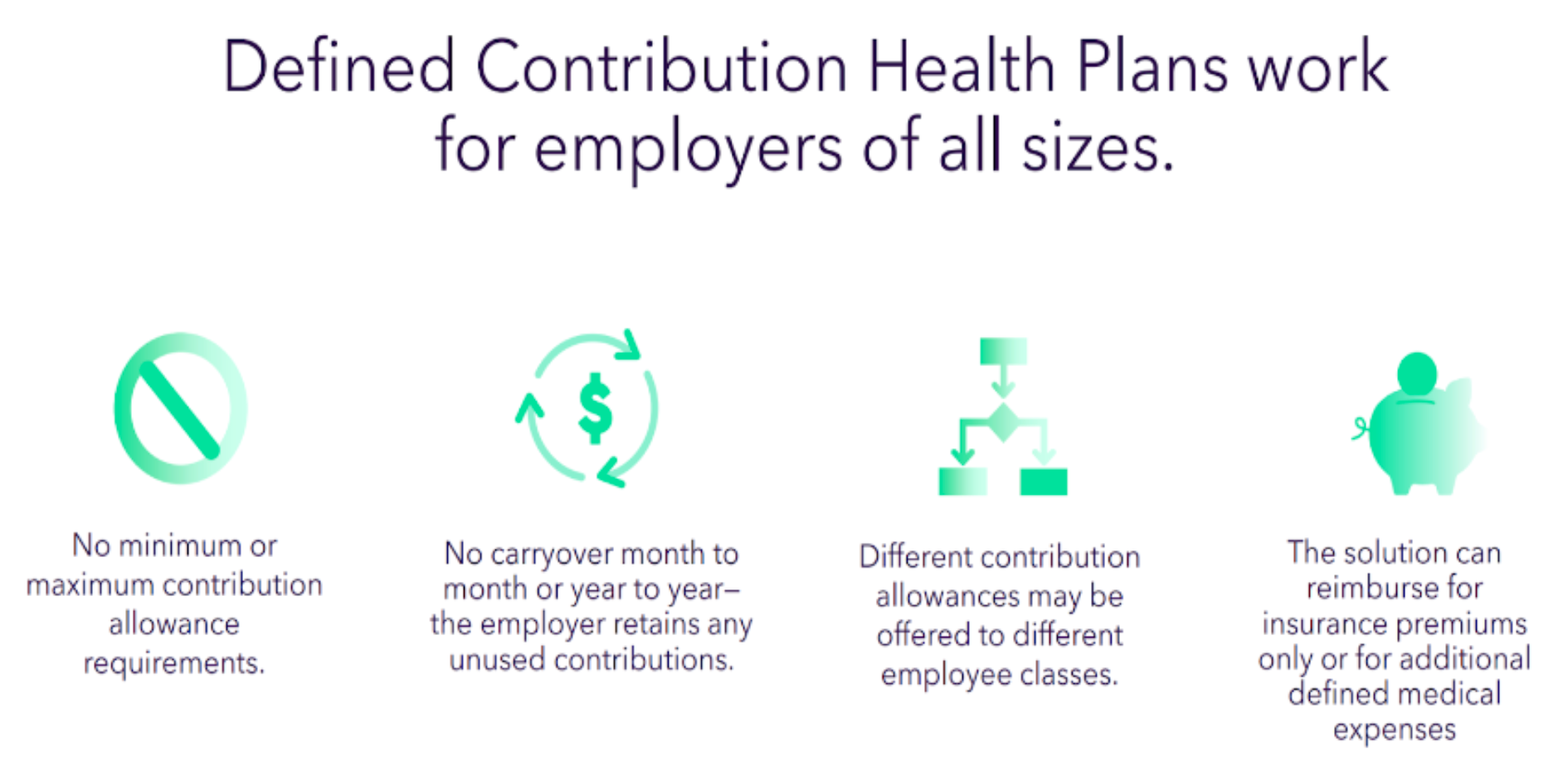

Unlike traditional models, ICHRAs are a type of defined contribution plan.

Employers allocate a set amount of funds for each employee. These funds are then used by employees to purchase their individual insurance plans on the open market.

This approach carries distinct advantages for both employers and employees.

Employers benefit from predictable costs and simplified administration.

They no longer need to select a one-size-fits-all group plan but can instead offer a flexible benefit that adapts to diverse employee needs. For employees, the power of choice is a game-changer. They can select a plan that best suits their personal or family needs, enjoy coverage protections, and retain their plan even if they change jobs.

Gone are the days when individual plans were only for the healthy.

Now, everyone can access quality coverage, free from the fear of being denied for pre-existing conditions or facing inflated premiums due to health issues. Welcome to the new era of healthcare, where flexibility and individual choice lead the way.

CUSTOM-BUILT FOR YOU, CUSTOM-TAILORED FOR THE UNIQUE NEEDS OF EACH EMPLOYEE

Great benefits don’t have to be expensive.

Whatever your benefits budget, big or small, we will stretch every dollar to get the biggest bang for your benefit bucks. They must be communicated, simple to use, and personalized to the unique needs of each employee. Don’t waste money on benefits employees don’t use, don’t value, and lack appreciation. We custom-build benefits for your company and custom-tailor them for the unique needs of each employee.

Simply fill out the contact form on the bottom right hand corner of this page and we will develop a cost savings analysis and implementation plan specifically for your company, at no cost or obligation.

Frequently Asked Questions

Do we have to wait until our group health renewal?

No, we can set up your plan anytime.

Why hasn’t our broker told us about this?

Traditional group benefits brokers may need to learn about the changes to the tax code and new laws that expanded HRAs (in existence since 2002) to include Individual Coverage HRAs in 2020. Furthermore, most brokers need more experience, proper licensing and certifications, technology, staff, and a call center with licensed benefit advisers to enroll employees, provide year-round concierge services, and administer HRAs effectively.

What size employers do you work with?

Small to mid-size employers with two or more employees.

We don’t have health benefits. What will this cost us?

We can work with almost any budget. Generally speaking, $250/month per employee is a good starting point.